Where in the U.S. Is Rent the Most (and Least) Affordable

Many Americans have been feeling the sting of high rent prices lately. With high housing costs across the U.S. and increasing mortgage rates, more people are being priced out of the market and have to rent instead. This has led to an increase in the demand for apartments and ultimately an increase in prices to meet that demand. This has led to many, including us, wondering, what are the most affordable cities in the U.S. for renting? And which cities should be avoided due to having the least affordable housing for rent in the country?

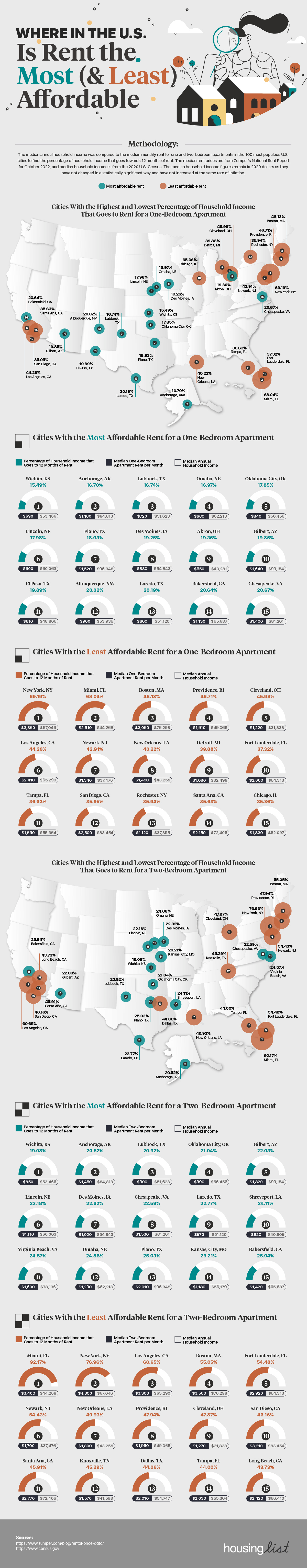

The research team at HousingList pulled rental price data from the National Rent Report and compared it to the median household income in the 100 most populous U.S. cities to determine where to find the most and least affordable rentals. According to the U.S. Census Bureau, the median annual household income for the United States is $64,994. The team left the household income data in 2020 dollars, as incomes haven't changed in a statistically significant way or increased at the same rate as inflation. What are the average rent prices in the U.S.? Zumper's rental report shares that the national one-bedroom median rent was $1,491 and two-bedroom median rent was $1,832 per month as of October 2022. Read on to see which cities have cheap places to rent and which cities are pricing residents out with their lack of affordable houses for rent.

Which City Has the Most Affordable Rent?

The U.S. city with the most affordable apartments for rent is Wichita, Kansas. Wichita has some of the cheapest rent in America; a one-bedroom apartment in Wichita has a median price of $690 per month, while a two-bedroom is slightly higher at $850 a month. With a median annual household income of $53,466 in Wichita, the percentage of income that goes toward 12 months of rent is 15.49% or 19.08% for a one- or two-bedroom apartment, respectively.

The Five Cities With the Most Affordable One-Bedroom Rent

- Wichita, KS: 15.49%

- Anchorage, AK: 16.7%

- Lubbock, TX: 16.74%

- Omaha, NE: 16.97%

- Oklahoma City, OK:

The Five Cities With the Most Affordable Two-Bedroom Rent

- Wichita, KS: 19.08%

- Anchorage, AK: 20.52%

- Lubbock, TX: 20.92%

- Oklahoma City, OK: 21.04%

- Gilbert, AZ: 22.03%

Which City Has the Least Affordable Rent?

The least affordable cities in the U.S. to rent an apartment in are New York City and Miami. Each city takes the first or second spot on the lists of cities with the least affordable rent. New York City has the highest median rent in the U.S for both a one-bedroom and two-bedroom apartment, but the median household income in NYC was just above the national average, at $67,046. The median rent for a one-bedroom in NYC is $3,860, meaning 69.19% of the household income going toward 12 months of rent. The median monthly rent for a two-bedroom in New York City is quite a bit higher at $4,300 per month, eating up 76.96% of household income.

Miami's above-average rental costs and below-average household incomes are to blame for the city having some of the least affordable homes for rent in the country. According to the U.S. Census, Miami has a low median household income that falls 32% below the national average at just $44,268. How much does it cost to rent an apartment in Miami? Rental prices in Miami were found to be roughly 40% higher than the national average. The median one-bedroom rent in Miami is $2,510, meaning 68.04% of household income would go toward 12 months of rent. If you think that's bad, the percentage of household income that would go toward a two-bedroom apartment is astronomical. Twelve months of the median monthly rent of $3,400 for a two-bedroom apartment in Miami would equal 92.17% of the total household income!

The 5 Cities With the Least Affordable One-Bedroom Rent

- New York, NY: 69.19%

- Miami, FL: 68.04%

- Boston, MA: 48.13%

- Providence, RI: 46.71%

- Cleveland, OH: 45.98%

The 5 Cities With the Least Affordable Two-Bedroom Rent

- Miami, FL: 92.17%

- New York, NY: 76.96%

- Los Angeles, CA: 60.65%

- Boston, MA: 55.05%

- Fort Lauderdale, FL: 54.48%

Will Rent Prices in the U.S. Continue to Rise?

While rental prices are abnormally high right now in many places around the U.S. and many can't afford rent, there is hope that these exorbitant prices will be lower in the future. According to Zumper's rent report, the national one-bedroom median rent was down 0.8% in October over the previous month and two-bedroom median rent was down 0.7%. They found that more than half of the cities on the list posted month-over-month declines, while another 19 cities remained flat. Just 20 percent of the cities are still seeing month-over-month increases, but these are also the same cities that Americans have been flocking to in recent years.

Cities With the Most Affordable Rent for a One-Bedroom Apartment

| Ranking | City | Median One-Bedroom Apartment Rent per Month | Median Household Income | Percentage of Household Income That Goes to Rent |

|---|---|---|---|---|

| 1 | Wichita, KS | $690 | $53,466 | 15.49% |

| 2 | Anchorage, AK | $1,180 | $84,813 | 16.70% |

| 3 | Lubbock, TX | $720 | $51,623 | 16.74% |

| 4 | Omaha, NE | $880 | $62,213 | 16.97% |

| 5 | Oklahoma City, OK | $840 | $56,456 | 17.85% |

| 6 | Lincoln, NE | $900 | $60,063 | 17.98% |

| 7 | Plano, TX | $1,520 | $96,348 | 18.93% |

| 8 | Des Moines, IA | $880 | $54,843 | 19.25% |

| 9 | Akron, OH | $650 | $40,281 | 19.36% |

| 10 | Gilbert, AZ | $1,640 | $99,154 | 19.85% |

| 11 | El Paso, TX | $810 | $48,866 | 19.89% |

| 12 | Albuquerque, NM | $900 | $53,936 | 20.02% |

| 13 | Laredo, TX | $860 | $51,120 | 20.19% |

| 14 | Bakersfield, CA | $1,130 | $65,687 | 20.64% |

| 15 | Chesapeake, VA | $1,400 | $81,261 | 20.67% |

Cities With the Least Affordable Rent for a One-Bedroom Apartment

| Ranking | City | Median One-Bedroom Apartment Rent per Month | Median Household Income | Percentage of Household Income That Goes to Rent |

|---|---|---|---|---|

| 1 | New York, NY | $3,860 | $67,046 | 69.19% |

| 2 | Miami, FL | $2,510 | $44,268 | 68.04% |

| 3 | Boston, MA | $3,060 | $76,298 | 48.13% |

| 4 | Providence, RI | $1,910 | $49,065 | 46.71% |

| 5 | Cleveland, OH | $1,220 | $31,838 | 45.98% |

| 6 | Los Angeles, CA | $2,410 | $65,290 | 44.29% |

| 7 | Newark, NJ | $1,340 | $37,476 | 42.91% |

| 8 | New Orleans, LA | $1,450 | $43,258 | 40.22% |

| 9 | Detroit, MI | $1,080 | $32,498 | 39.88% |

| 10 | Fort Lauderdale, FL | $2,000 | $64,313 | 37.32% |

| 11 | Tampa, FL | $1,690 | $55,364 | 36.63% |

| 12 | San Diego, CA | $2,500 | $83,454 | 35.95% |

| 13 | Rochester, NY | $1,120 | $37,395 | 35.94% |

| 14 | Santa Ana, CA | $2,150 | $72,406 | 35.63% |

| 15 | Chicago, IL | $1,830 | $62,097 | 35.36% |

Cities With the Most Affordable Rent for a Two-Bedroom Apartment

| Ranking | City | Median Two-Bedroom Apartment Rent per Month | Median Household Income | Percentage of Household Income That Goes to Rent |

|---|---|---|---|---|

| 1 | Wichita, KS | $850 | $53,466 | 19.08% |

| 2 | Anchorage, AK | $1,450 | $84,813 | 20.52% |

| 3 | Lubbock, TX | $900 | $51,623 | 20.92% |

| 4 | Oklahoma City, OK | $990 | $56,456 | 21.04% |

| 5 | Gilbert, AZ | $1,820 | $99,154 | 22.03% |

| 6 | Lincoln, NE | $1,110 | $60,063 | 22.18% |

| 7 | Des Moines, IA | $1,020 | $54,843 | 22.32% |

| 8 | Chesapeake, VA | $1,530 | $81,261 | 22.59% |

| 9 | Laredo, TX | $970 | $51,120 | 22.77% |

| 10 | Shreveport, LA | $820 | $40,809 | 24.11% |

| 11 | Virginia Beach, VA | $1,600 | $78,136 | 24.57% |

| 12 | Omaha, NE | $1,290 | $62,213 | 24.88% |

| 13 | Plano, TX | $2,010 | $96,348 | 25.03% |

| 14 | Kansas, City, MO | $1,180 | $56,179 | 25.21% |

| 15 | Bakersfield, CA | $1,420 | $65,687 | 25.94% |

Cities With the Least Affordable Rent for a Two-Bedroom Apartment

| Ranking | City | Median Two-Bedroom Apartment Rent per Month | Median Household Income | Percentage of Household Income That Goes to Rent |

|---|---|---|---|---|

| 1 | Miami, FL | $3,400 | $44,268 | 92.17% |

| 2 | New York, NY | $4,300 | $67,046 | 76.96% |

| 3 | Los Angeles, CA | $3,300 | $65,290 | 60.65% |

| 4 | Boston, MA | $3,500 | $76,298 | 55.05% |

| 5 | Fort Lauderdale, FL | $2,920 | $64,313 | 54.48% |

| 6 | Newark, NJ | $1,700 | $37,476 | 54.43% |

| 7 | New Orleans, LA | $1,800 | $43,258 | 49.93% |

| 8 | Providence, RI | $1,960 | $49,065 | 47.94% |

| 9 | Cleveland, OH | $1,270 | $31,838 | 47.87% |

| 10 | San Diego, CA | $3,210 | $83,454 | 46.16% |

| 11 | Santa Ana, CA | $2,770 | $72,406 | 45.91% |

| 12 | Knoxville, TN | $1,570 | $41,598 | 45.29% |

| 13 | Dallas, TX | $2,010 | $54,747 | 44.06% |

| 14 | Tampa, FL | $2,030 | $55,364 | 44.00% |

| 15 | Long Beach, CA | $2,420 | $66,410 | 43.73% |